Connect with FilingBuddy +91-7303276300

📑 Annual Compliances for One Person Company (OPC)

Every One Person Company (OPC) needs to stay compliant! Annual compliance ensures your OPC runs smoothly, avoids penalties and builds trust with Banks, Investors and Clients

⚡ Why is OPC Annual Compliance Important?

✅ Avoid heavy penalties 🚫💸

✅ Maintain legal standing 🏛️

✅ Build credibility with banks/investors 🏦

✅ Smooth business operations 🔄

✅ Future funding & expansion-ready 🚀

🚀 Why Choose Online Filing India?

24×7 WhatsApp FilingBuddy Support 🤝

Dedicated Compliance Manager 👨💼

Transparent Pricing, No Hidden Charges 💳

On-time Filing Guarantee ⏰

100% Online Process 🌐

- More than 1000 OPC Filings done 📊

Our OPC Compliance Packages

🏗️ Foundation Plan

🚀 Expansion Plan

💼 Success Plan

Best for: Newly formed OPCs that want to stay compliant with minimum yearly filings

✅ Inclusions:

💻 Maintenance of Books of Accounts

📈 Preparation of Financial Statements

🔎 Statutory Audit

📄 Filing of ITR of Company

🪪 Director KYC

📎 Filing of Form AOC-4

📌 Filing of Form MGT-7A

- 🗓️ Compliance Calendar

👨💻 Dedicated FilingBuddy Support

Best for: Growing OPCs for subsequent year filings upto 200 entries in Bank Statement

✅ Inclusions:

💻 Maintenance of Books of Accounts (upto 200 entries)

📈 Preparation of Financial Statements

🔎 Statutory Audit

📄 Filing of ITR of Company

🪪 Director KYC

📎 Filing of Form AOC-4

📌 Filing of Form MGT-7A

- 🗓️ Compliance Calendar

👨💻 Dedicated FilingBuddy Support

Best for: Established OPCs wanting all-round compliance coverage

✅ Inclusions:

💻 Maintenance of Books of Accounts (No entry Limit)

📈 Preparation of Financial Statements

🔎 Statutory Audit

📄 Filing of ITR of Company

📄 Filing of ITR of 1 Director

🪪 Director KYC

📎 Filing of Form AOC-4

📌 Filing of Form MGT-7A

- 🗓️ Compliance Calendar

👨💻 Dedicated FilingBuddy Support

❓ Frequently Asked Questions – OPC Annual Compliance

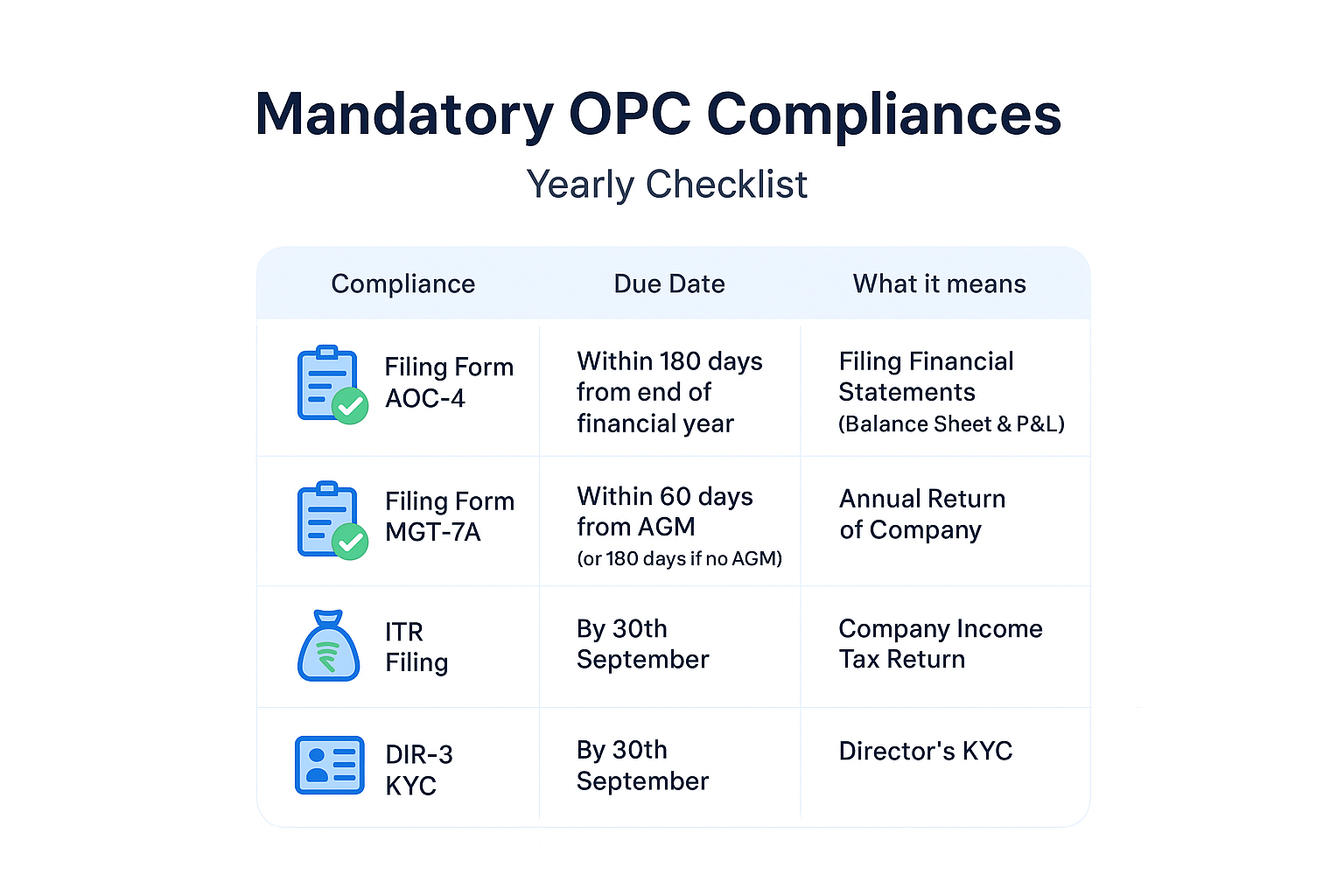

1️⃣ What are the annual compliances of an OPC?

👉 Filing of Form AOC-4 (Financial Statements) and Form MGT-7A (Annual Return) with ROC.

👉 Income Tax Return (ITR) filing.

👉 Board Meeting & Minutes (at least one in every half year).

👉 Other compliance as per applicable laws (GST, TDS, PF, ESI, etc. if applicable).

2️⃣ Is annual compliance mandatory for an OPC even if there is no business?

✅ Yes. Even if your OPC has zero transactions, annual filings are compulsory.

⚠️ Non-compliance may lead to penalties and even strike-off of your company.

3️⃣ What is the due date for OPC annual compliance?

📅 AOC-4 (Financial Statement): Within 180 days from end of financial year (i.e. 27th September if FY ends 31st March).

📅 MGT-7A (Annual Return): Within 60 days from AGM due date (AGM not mandatory for OPC, but form filing is required).

📅 ITR: 31st July (if no audit), 30th September (if audit applicable).

4️⃣ What happens if OPC annual compliances are not filed?

⚠️ Heavy late fees @ ₹100 per day per form until filing.

⚠️ Possible disqualification of director.

⚠️ Chances of company strike-off by ROC.

5️⃣ How much does it cost to maintain OPC compliance yearly?

💰 Cost depends on the package chosen – Foundation 🏗️, Expansion 🚀, or Success 💼.

👉 On average, compliance cost is ₹8,000 – ₹20,000 yearly, depending on requirements.

6️⃣ Do I need a full-time CA/CS for OPC compliance?

❌ No.

✅ With Online Filing India, your OPC gets a dedicated FilingBuddy, expert CA/CS support, and 24×7 WhatsApp assistance at a fraction of the cost.

7️⃣ Can I convert my OPC to a Private Limited Company later?

✅ Yes, OPC can be converted into Private Limited (voluntarily after 2 years or mandatorily if turnover crosses ₹2 Cr / paid-up capital exceeds ₹50 Lakh).

8️⃣ Why choose Online Filing India for OPC compliance?

💡 Because we provide:

✔️ All-in-one yearly packages (no hidden costs)

✔️ Reminders & updates on WhatsApp

✔️ Dedicated FilingBuddy support

✔️ 100% online process – PAN India